The Of Clark Finance Group Refinance Home Loan

Table of ContentsAn Unbiased View of Clark Finance Group Home Loan CalculatorFacts About Mortgage Broker UncoveredGetting My Refinance Home Loan To WorkClark Finance Group Refinance Home Loan - The Facts

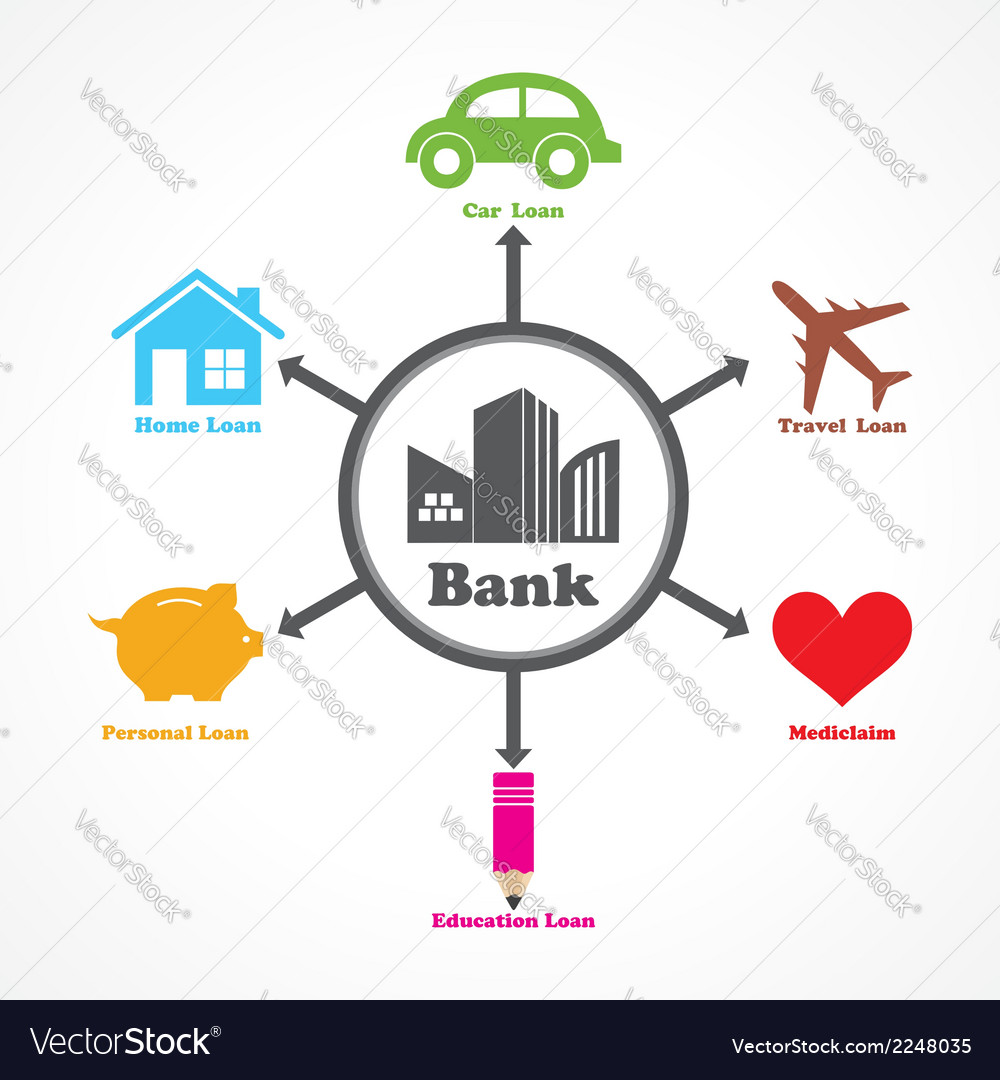

Kinds of Loans, Individual car loans - You can obtain these car loans at practically any kind of bank. Individual loans are typically unsafe and fairly simple to obtain if you have average credit rating background.These fundings are safeguarded by the home or home you are buying. That indicates if you do not make your payments in a timely fashion, the financial institution or lender can take your house or building back! Home loans aid individuals get involved in homes that would or else take years to save for. They are commonly structured in 10-, 15- or 30-year terms, and also the passion you pay is tax-deductible and also rather low contrasted to various other finances.

The equity or finance quantity would be the distinction between the assessed value of your residence as well as the quantity you still owe on your home loan. These fundings benefit home enhancements, home renovations or financial debt combination. The rates of interest is frequently tax deductible and additionally relatively reduced compared to other fundings.

They do require a little bit even more work than normal as well as typically require a company plan to show the validity of what you are doing. These are commonly safe loans, so you will certainly have to promise some personal properties as collateral in case business falls short. Advantages of Financings, Company growth and also growth - Fundings are an excellent method for a service to increase and expand quicker than it or else could.

The Ultimate Guide To Mortgage Broker

Passion - Paying simply the rate of interest on multiple loans can finish up setting you back people tens of thousands of bucks a year. One lending might be convenient, however add a house loan, 2 vehicle loan, student car loans additional info and also a few credit rating card advances right into the mix, and the rate of interest can leave control extremely promptly.

You do it a lot of times, and the financial institution or loaning institution can legitimately reclaim your residence that you have been paying on for 10 years! Lesson Recap, A funding is when you get cash from a close friend, financial institution or banks for future repayment of the principal as well as passion.

9 Easy Facts About Clark Finance Group Mortgage Broker Described

Individual fundings supply you quickly, adaptable accessibility to funds that can be utilized for lots of significant life events, costs or combining financial obligation, all with one taken care of regular monthly repayment. Consolidate credit rating card financial debt Streamline your regular monthly expenses by combining your high rate of interest debt Refurbish your house Upgrade your space without utilizing your residence as security Purchase or repair a car Purchase the ideal loan price and acquisition or repair your auto anywhere Take a trip Money your whole trip or utilize it for investing cash Fund your wedding celebration Spread the look at this web-site expense of your huge day over months or years Cover medical expenditures Cover unanticipated costs or prepared treatments.

You after that pay back the quantity gradually. You'll most likely also pay a particular amount of passion. Rate of interest is a fee you pay to obtain the money. It's typically a percent of the lending included on top of what you already owe. 1 When it comes to just how much passion you'll pay, there are various rate of interest rates for various kinds of financings.

Far, so great. The challenging component of seeking a lending comes when you begin looking for sorts of consumer loans. You're bound to discover lengthy checklists and complicated terms like "protected" and also "unsecured" (which are not describing how you really feel right now). As you discover financings, learning more about crucial expressions and terms can assist you find the appropriate type for you.

Kinds of little service car loans Typical or term financings A term finance, which is additionally described as a conventional finance, is financing borrowed from a bank that needs to be paid back over a set period of time. This can be either a brief or extended period, varying from a couple of months to numerous years.

Fascination About Home Loan Lender

SBA lendings The Small company Management (SBA) funds several lendings that are assured by the federal government - Mortgage broker. The most common sort of SBA loan is the SBA 7(a) funding. It has an optimum limit of $5 million as well as is usually used to purchase realty, in addition to for functioning resources and financial debt refinancing.

SBA microloans are extended as much as $5,000 with the intent to assist small companies expand as well as invest in their operating funding, inventory, and also devices. Tools financing car loans An equipment funding funding is one that allows proprietors to buy equipment and also equipment for their operations. flagstar my loans Organizations can utilize a finance toward office equipment as well as devices for staff members or to manufacture products.

Unlike other fundings, businesses will need to make a down settlement prior to getting the lending. The most typical kind of SBA financing is the SBA 7(a) car loan.